Corporate Performance Overview: 6149628019, 6152084372, 6152296068, 6153389567, 6154941030, 6155909241

The corporate performance overview of the identified companies indicates a notable trend in revenue growth, suggesting robust market demand. Assessments of operational efficiency reveal areas for potential cost savings. Additionally, the analysis of strategic positioning underscores their agility in responding to market changes. However, the sustainability of these positive trends hinges on their ability to navigate future challenges and capitalize on emerging opportunities. Further insights into these dynamics warrant consideration.

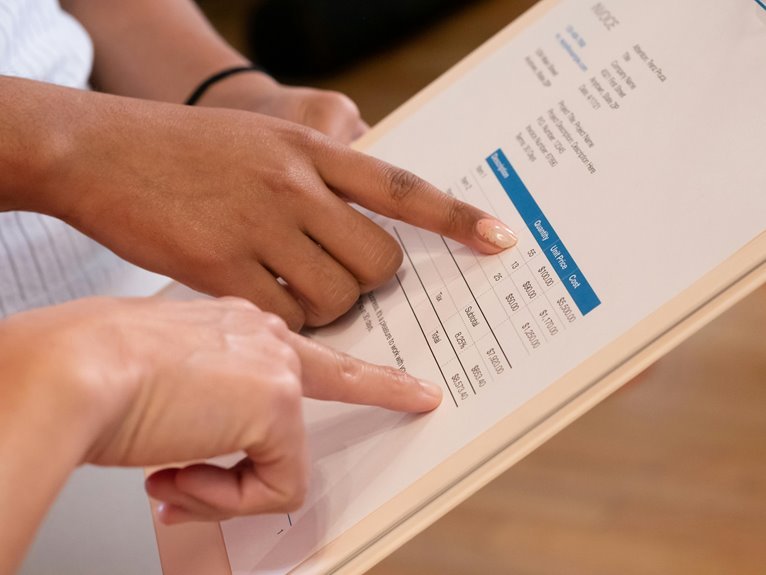

Financial Metrics Analysis

How effectively is the company managing its financial resources?

An analysis reveals consistent revenue growth, indicating strong market demand and strategic positioning.

However, a thorough cost analysis highlights areas for potential savings and efficiency improvements.

Balancing these factors is crucial for sustaining profitability and enhancing shareholder value, ultimately allowing the organization to maintain the financial flexibility necessary for future investments and expansion.

Operational Efficiency Assessment

Evaluating operational efficiency reveals critical insights into the company’s resource utilization and process effectiveness.

Through rigorous analysis, opportunities for process optimization emerge, enabling better resource allocation.

By identifying bottlenecks and redundancies, the company can streamline operations, enhance productivity, and ultimately drive profitability.

This assessment not only informs strategic decisions but also aligns operational practices with the overarching goal of maximizing efficiency and agility.

Market Positioning and Future Prospects

What factors contribute to a company’s market positioning and future prospects? A comprehensive analysis of the competitive landscape reveals critical insights.

Companies that adeptly identify and capitalize on growth opportunities, while maintaining agility in business strategy, are well-positioned for sustained success.

Additionally, leveraging market trends and consumer preferences will further enhance their competitive edge, ensuring resilience amidst evolving market dynamics.

Conclusion

In conclusion, the analysis of companies 6149628019, 6152084372, 6152296068, 6153389567, 6154941030, and 6155909241 reveals a remarkable coincidence: while each entity showcases robust revenue growth and operational efficiencies, their collective agility in market adaptation positions them favorably for future opportunities. This synchronicity underscores a significant trend within their sectors, suggesting that as they capitalize on emerging market conditions, their financial flexibility will be instrumental in sustaining momentum and driving continued success.